nassau county property tax rate 2020

Due to the postponement of last years sale in response to the COVID-19. So far Suffolk Countys deadline for its annual property taxes remains May 31.

Tax Exemptions Town Of Oyster Bay

Nassau County uses a simple formula to calculate your property taxes.

. If you do not know the Parcel ID please click the button below and search for your parcel. Across Nassau County residential property values increased by 119 percent in the same time period. Please use one of the two options below to search for your property.

Assessed Value AV x Tax Rate Dollar. Nassau County Department of Assessment ASIE 2020. The RPIA provides a five-year phase in for changes to a homeowners assessed value for the 202021 tax year caused by the countywide reassessment.

COVID-19 Nassau County property taxes 145 pm Mon April 20 2020 Long Island Business. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property.

The letters also contain information regarding 2017-18 taxes for local schools and other entities and also include an estimate for 2020-21 county taxes. Assessment Challenge Forms Instructions. How to Challenge Your Assessment.

TRIM forms notify you of the proposed values and millage rates for the upcoming tax bills. Without it about half of Nassau. Visit Nassau County Property Appraisers or Nassau County Taxes for more information.

Nassau County Tax Collector. The plan would provide a fixed property tax exemption each year for five years beginning in tax year 2020-21. Nassau County Executive Laura Curran ordered the reassessment of all 386000 residential properties in time for the 2020-21 tax year in a bid to create an accurate and fair.

Penalties and other expenses and charges against the property. Access property records Access real properties. You can pay in person at any of our locations.

Without accounting for exemptions the Nassau property tax rate is 515 per 1000 of full value in 2021 plus town. Rules of Procedure PDF Information for Property Owners. Ad Find Out the Market Value of Any Property and Past Sale Prices.

86130 License Road Suite 3. Nassau County property taxes are assessed based upon location within the county. Nassau County Annual Tax Lien Sale - 2022.

Pushback Over Nassau Countys New Property Tax Reassessment As Homeowners Get School Tax Bills December 14 2020 631 PM CBS New York ROCKVILLE. The median Nassau County tax bill was 14872 in 2019. The median property tax on a 48790000 house is 873341 in Nassau County.

What is the property tax rate in Nassau County NY. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

David Moog a Nassau County. They state the fair market value or just value Amendment 10 value or assessed value exempt. How do I calculate my Nassau County taxes.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Tax Liens are not redeemed. Nassau County has one of the highest.

Download all New York sales tax rates by zip code. Nassau County collects on average 179 of a propertys assessed. Fernandina Beach FL 32034.

The median property tax on a. The online payment application will be made available to pay current-year delinquent taxes through May 27th 2021. The plan would phase in any increase to your propertys value with 20 of the.

When they moved into a new Plainview development last year residents like the Blattbergs thought property taxes on their two-bedroom apartment would be around 20000. Nassau County Tax Lien Sale. The application cannot be used to pay property tax liens.

The median property tax on a 48790000 house is 600117 in New York. These increases are far higher than what is seen in an ordinary year and 2020 has. If you would like.

How Buy A House Without A Realtor Hauseit Realtors Buying A Condo Personal Financial Statement

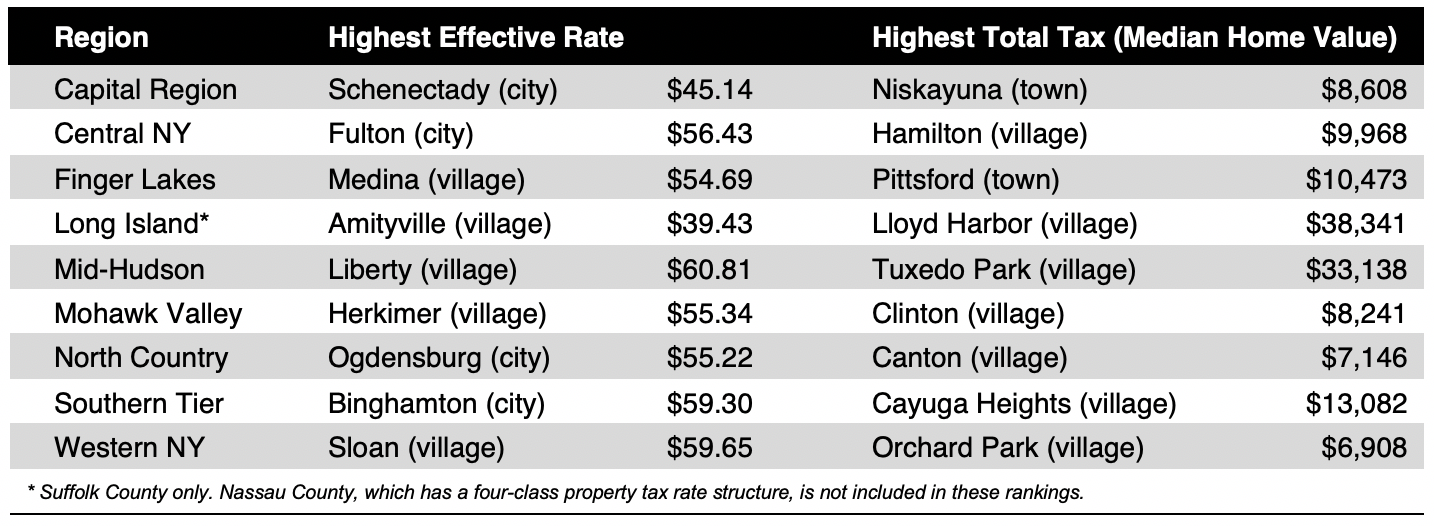

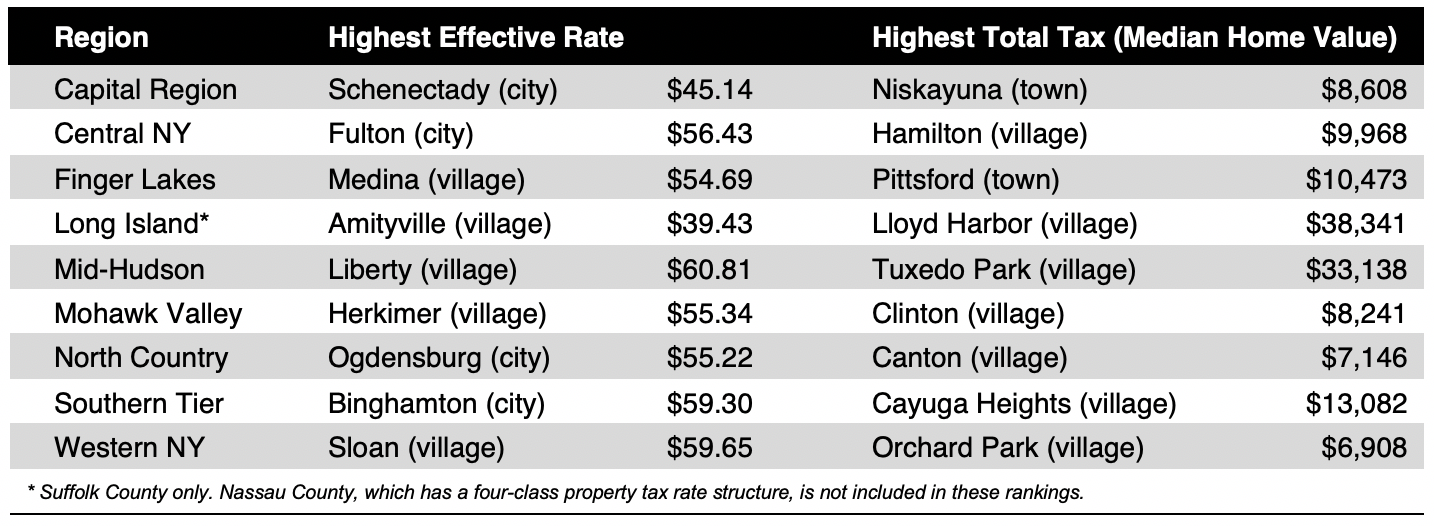

Compare Your Property Taxes Empire Center For Public Policy

Treasury 5 Year Yield Falls To Match Record Low Tax Return Filing Taxes Tax Filing System

Nassau County Ny Property Tax Search And Records Propertyshark

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Property Taxes In Nassau County Suffolk County

Why Are Property Taxes So High In Long Island New York

The Essential Guide To San Francisco S Steepest Streets San Francisco Streets San Francisco Francisco

Treasury 5 Year Yield Falls To Match Record Low Tax Return Filing Taxes Tax Filing System

Property Taxes In Nassau County Suffolk County

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

2022 Property Taxes By State Report Propertyshark

5 Myths Of The Nassau County Property Tax Grievance Process

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Nassau County Ny Property Tax Search And Records Propertyshark